-40%

Home In Phoenix Arizona Metro Area, Maricopa County, Pre-Foreclosure (Tax Lien)

$ 52.8

- Description

- Size Guide

Description

Created withEselt

-

Templates for eBay Sellers

Created with

Eselt

-

Templates for eBay Sellers

Created with

Eselt

-

Templates for eBay Sellers

Home In Phoenix Arizona Metro Area, Maricopa County, Pre-Foreclosure (Tax Lien)

Bidding is for the Tax Certificate Only.

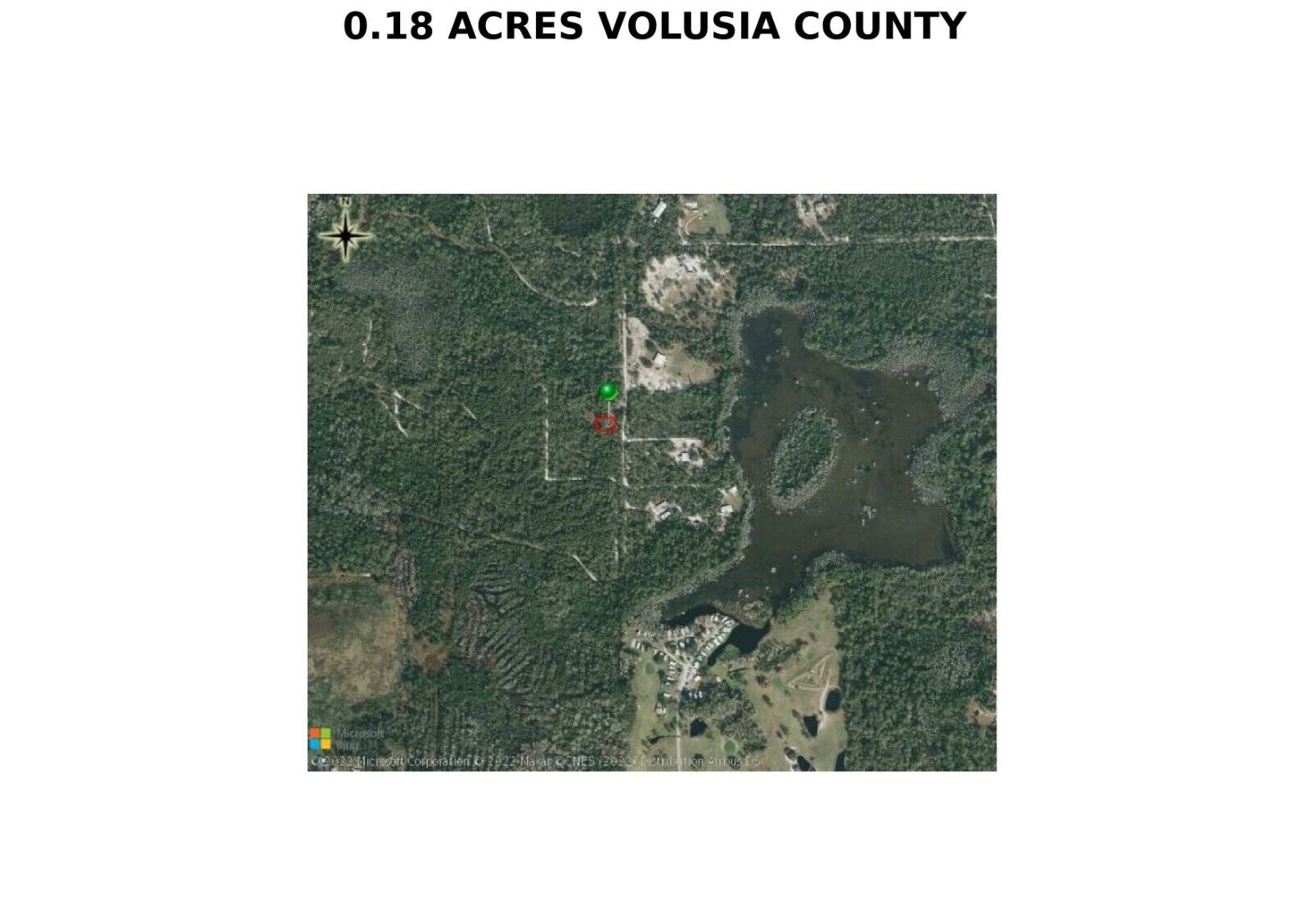

The tax certificate being auctioned was issued by a

Arizona

County

.

The certificate is a lien on a

Real Estate

located in Maricopa

County

Arizona.

The Buyer is bidding on a County Issued Tax Certificate for Back Taxes from

Maricopa

County

Arizona

. Buyer must do any and all necessary research regarding tax certificates before bidding. Please be advised that the Redemption amount is based on the face value of the Tax Lien Certificates and NOT the final bid amount. Please note seller has not visited the property. Buyer is advised to inspect property.

Under

Arizona

Law, property owner has

3

years from date of tax certificate issuance to redeem after which tax certificate holder can file a Tax Deed Application and send the

pro

perty to a Tax Deed Sale/Auction.

I have listed all information accurately and to the best of my knowledge, but as in any real estate transaction, you should do your due diligence before bidding.

Created with

Eselt

-

Templates for eBay Sellers

Payment

Buyer’s bidding on this tax lien implies that Buyer has completed their due diligence, is satisfied with their findings and is ready to purchase and pay for this real estate tax lien as agreed herein.

The buyer should understand state Tax Lien laws before bidding. The bid amount may be higher than the value of the Tax lien.

As such, Buyer shall ask Seller any and all questions prior to bidding and not wait until after they win this auction to start asking questions related to this purchase of a real estate tax lien. Buyer accepts full risk and responsibility for purchasing this tax lien, understanding that there are no guarantees being made

. The buyer is relying only on his or her findings about the tax liens and not any info in the ad.

Buyer understands that there are no refunds at any time. Buyer’s bidding on this tax lien implies that they agree to abide by the terms of this auction.

Payment/Transfer Fee: A Transfer Fee of

95

.00 will be added to the Winning Bid. Payment is due within

2

4

hours

from the conclusion of this auction/sale. Payment is to be made by Buyer to Seller

Certificated Check or

ACH Checking (I will send you the link to Make payment after auction is over)

Once payment is made to seller there are no refunds. Once Buyer’s total payment amount has been received by Seller, Buyer will receive a of the tax lien certificate transfer documents, with easy to follow instructions, via Mail. with this easy transfer.

Disclosure: The information in this listing is correct to the best of seller’s knowledge. Seller has not been to this property and only owns the tax lien certificate on it.

Shipping

Created with

Eselt

-

Templates for eBay Sellers